Spotlight What Matters Most in Your Customer Conversations

Spotlight Summaries are here to shine a light on key trends in your conversations. This new feature analyses multiple interactions

Previously EdgeTier investigated what was considered to be good customer service for the retail industry and compared it with 11 other industries that were analysed in the making of EdgeTier’s Digital Customer Support Analysis 2020. In this report, 200 brands across the UK and Ireland were examined on their email and chat support capabilities in…

Previously EdgeTier investigated what was considered to be good customer service for the retail industry and compared it with 11 other industries that were analysed in the making of EdgeTier’s Digital Customer Support Analysis 2020. In this report, 200 brands across the UK and Ireland were examined on their email and chat support capabilities in order to determine the most efficient industry when it comes to customer service.

In this blog post EdgeTier will take a closer look at the utilities sector and how the utilities industry compares with both its competition and the overall cross-industry average. EdgeTier will also outline industry benchmarks and suggestions on what it takes to provide best-in-class customer support.

The utilities industry is a vital industry for every economy, providing essential services to consumers and businesses and forming a significant portion of consumer and industry spending. In the UK alone, households spend £55bn on energy alone each year.

The utilities industry is certainly not without its challenges, with macro-trends such as infrastructure modernisation, renewable energy and climate change driving large developments within the industry. Additionally, because it is such an essential industry, utilities companies are amongst the most heavily regulated and commoditised companies in existence.

Competition is intense among utilities companies, with consumers and businesses both acutely aware of the savings that can be achieved by switching providers. Ofgem estimates that 20% of consumers switch energy providers each year. With such strong commoditisation and competition in the industry, customer service is one of the only differentiators available to utilities companies.

Providing good customer service is a key revenue driver both in terms of customer retention, as well as attracting new customers. As reported in the Harvard Business Review, companies at the top of their industries in Net Promoter Scores (NPS) or satisfaction rankings grow revenues roughly 2.5 times as fast as their industry peers and deliver two to five times the shareholder returns over a 10 year period. McKinsey also highlights the importance of good customer care, stating that personalisation at scale delivered through customer service can drive between 5% and 15% revenue growth for companies.

Despite the clear importance of good quality customer service amongst utilities companies, this report outlines some large disparities in the approach to digital customer service between the utilities industry versus other industries, as well as between companies within the utilities industry.

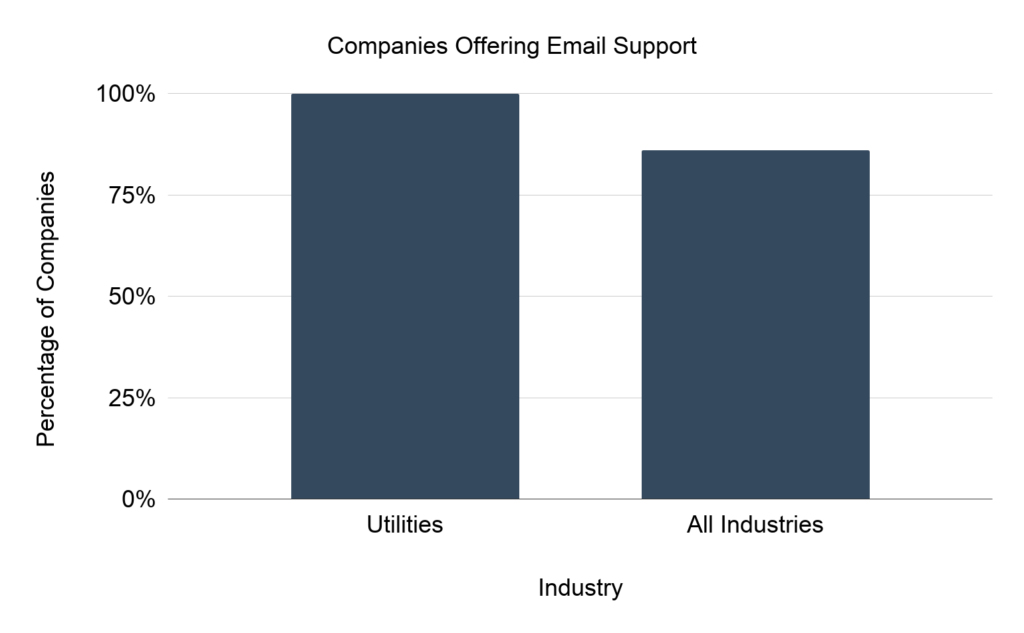

Email is by far the most popular method of digital support across the utilities industry. Every utility company examined offers support over email, which is much higher than the overall cross-industry level of email support, which is 86% of companies.

For live chat, 40% of the utilities companies implemented live chat support on their customer-facing pages, which is higher than the overall live chat uptake across all industries of 31%.

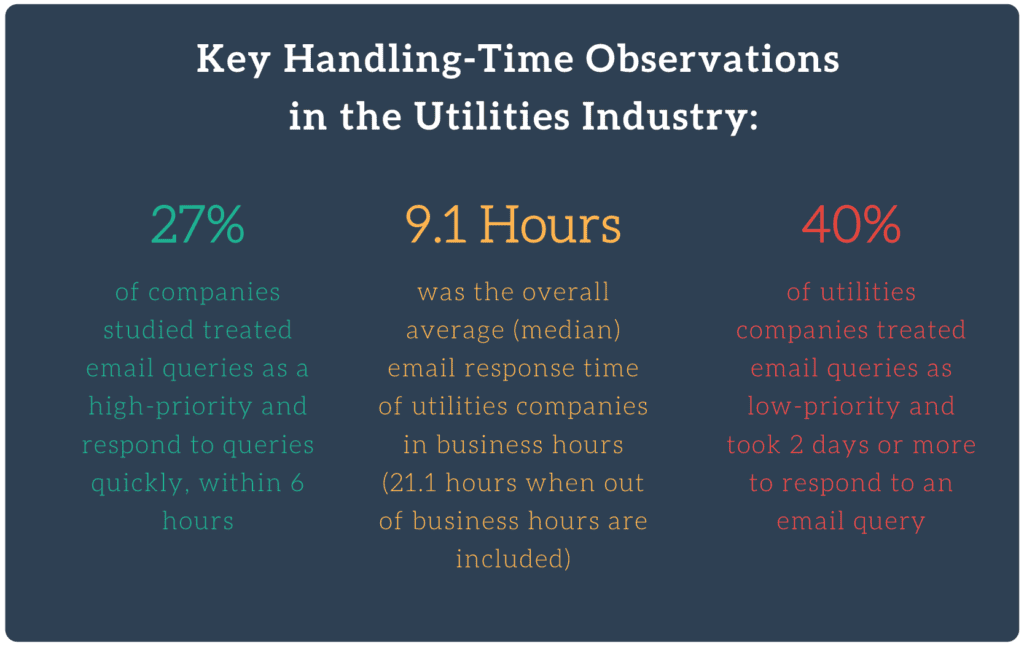

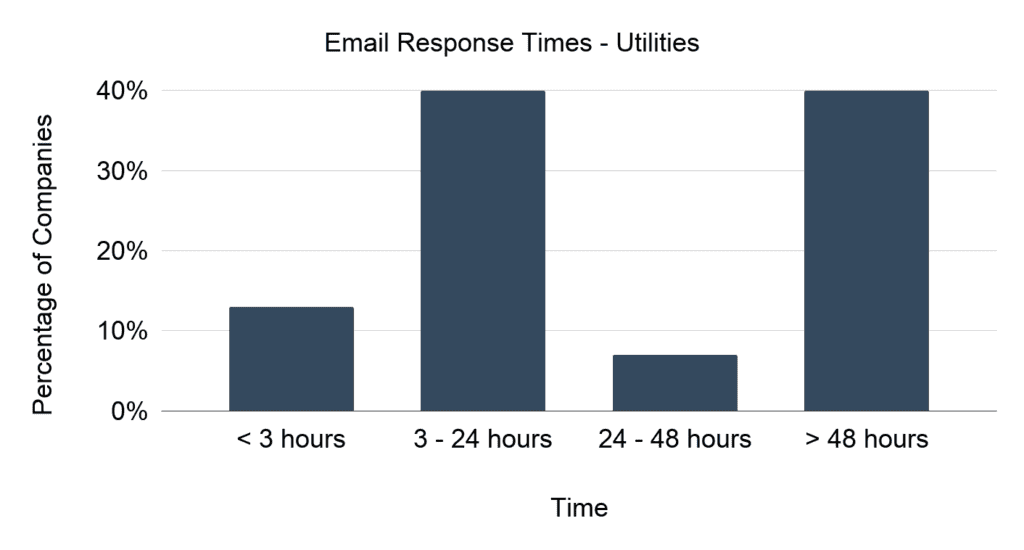

The response times of companies in the utilities industry, ranging from minutes to days. Examining the email channel first, 13% of all utilities companies responded within 3 hours of receiving an email. A further 40% of companies responded between 3 hours and 24 hours later, Overall, the median response time was 9.1 business hours from the time of sending an email.

The response times over email for utilities companies is below industry-average figures, indicating a poor level of email support overall throughout the utilities industry. However, there are some high performers, with the fastest response taking only 8 minutes.

Currently, only 7% of utilities companies respond within 2 hours of receiving an email, lagging behind the cross-industry average of 22% of overall companies that respond within 2 hours of receiving an email.

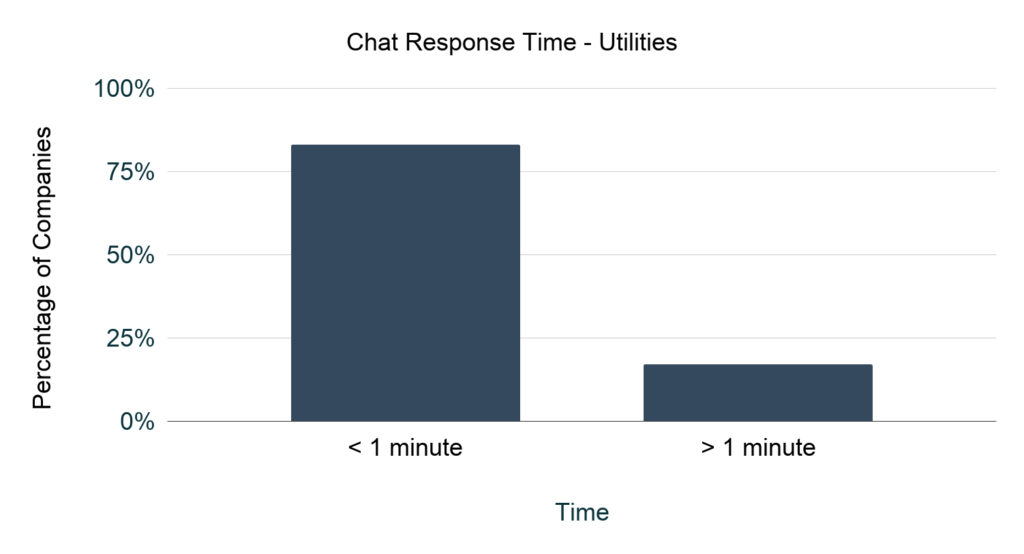

When examining chat, the utilities industry performs significantly better than email. 83% of utility companies answered a chat support query in under one minute (which compares favourably to the cross-industry average of 55%). The longest response time for chat was just over 3 minutes (coming from a water services company), while the fastest response time was 40 seconds (an electricity provider).

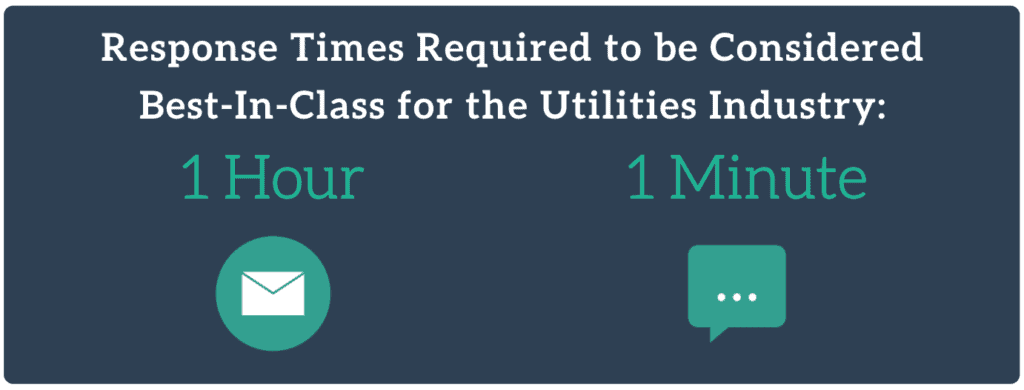

In order to determine best-in-class performance, the top 10% of utilities companies were evaluated. On the live chat channel, the top 10% of companies responded within 1 minute, in line with industry demands. Over email, the top 10% of companies responded within 1 hour of the email being sent. Therefore, in order to achieve best-in-class results, utilities companies need to target 1 minute chat response times and 1 hour email response times.

In such a commoditsed industry, it is surprising to see such poor email response times, with 40% of all utilities companies taking over 2 days to respond to an email query. A 48-hour wait time fails to meet the expectations of virtually all customers, and ensures a poor customer experience. While email is a well-used channel to provide support in the utilities industry, this research shows that is it not being leveraged properly when support levels are compared to other industries, or to customer expectations.

Support over chat fares slightly better, where 83% of chats were answered within a minute. This level of performance provides encouragement that some companies in the utilities industry are prioritising customer satisfaction. The rapid response times over chat also indicate that utilities companies who are currently not offering chat support have a high barrier to entry as they will need to meet 1-minute response times in order to compete with other utilities companies.

Differentiating based on customer service is one of the only ways for a utility company to stand out from competitors. Leaving a customer to wait for responses to their queries will drive down customer satisfaction scores and push that customer towards a competitor. Customers have become used to receiving instant, high-quality answers from many other industries and there are large gains to be made by utility companies who strive for this.

EdgeTier will continue to study companies in order to understand contact centre needs and improvements – if you would like to learn more about this research, or obtain more in depth results, you can get in touch through our website www.edgetier.com or email us directly on info@edgetier.com.

Spotlight Summaries are here to shine a light on key trends in your conversations. This new feature analyses multiple interactions

We’ve just added confusion detection to our emotion analysis tools. Now, you can easily spot when customers are confused, allowing

Discover how EdgeTier’s latest AI-powered updates can optimise your contact centre, including anomaly detection summaries, agent QA, and custom charts.

"I specifically liked the flexibility. I liked the can-do attitude. I always felt supported. There hasn’t been any single point in our journey where EdgeTier has said no."

"EdgeTier is really shining when it comes to responsible gambling. We can proactively track critical issues and take actions, reducing human error."

"The average response time for post-booking type emails is about five hours. Previously, it was over 24 hours."

Let us help your company go from reactive to proactive customer support.

Unlock AI Insights